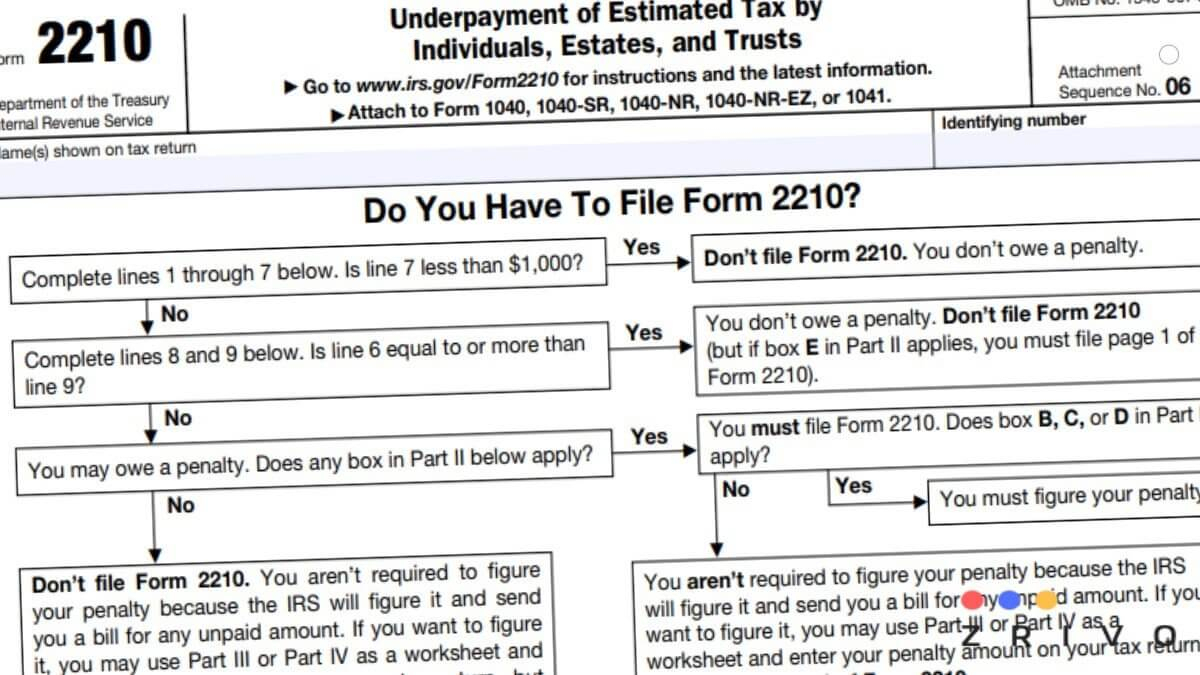

Irs Quarterly Tax Payment Form 2025 - 2021 Printable Irs 1040Ez Forms Example Calendar Printable, Calculate your upcoming quarterly tax payment, with this free tool for freelancers. Or, you can pay them using paper forms from the irs. FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2025, Opting for the irs online account streamlines the payment process, allowing taxpayers. Washington — many taxpayers make quarterly estimated tax.

2021 Printable Irs 1040Ez Forms Example Calendar Printable, Calculate your upcoming quarterly tax payment, with this free tool for freelancers. Or, you can pay them using paper forms from the irs.

Irs Quarterly Tax Payment Form 2025. 10 ways to make a tax payment in 2025. Irs federal tax payments deadline 2025.

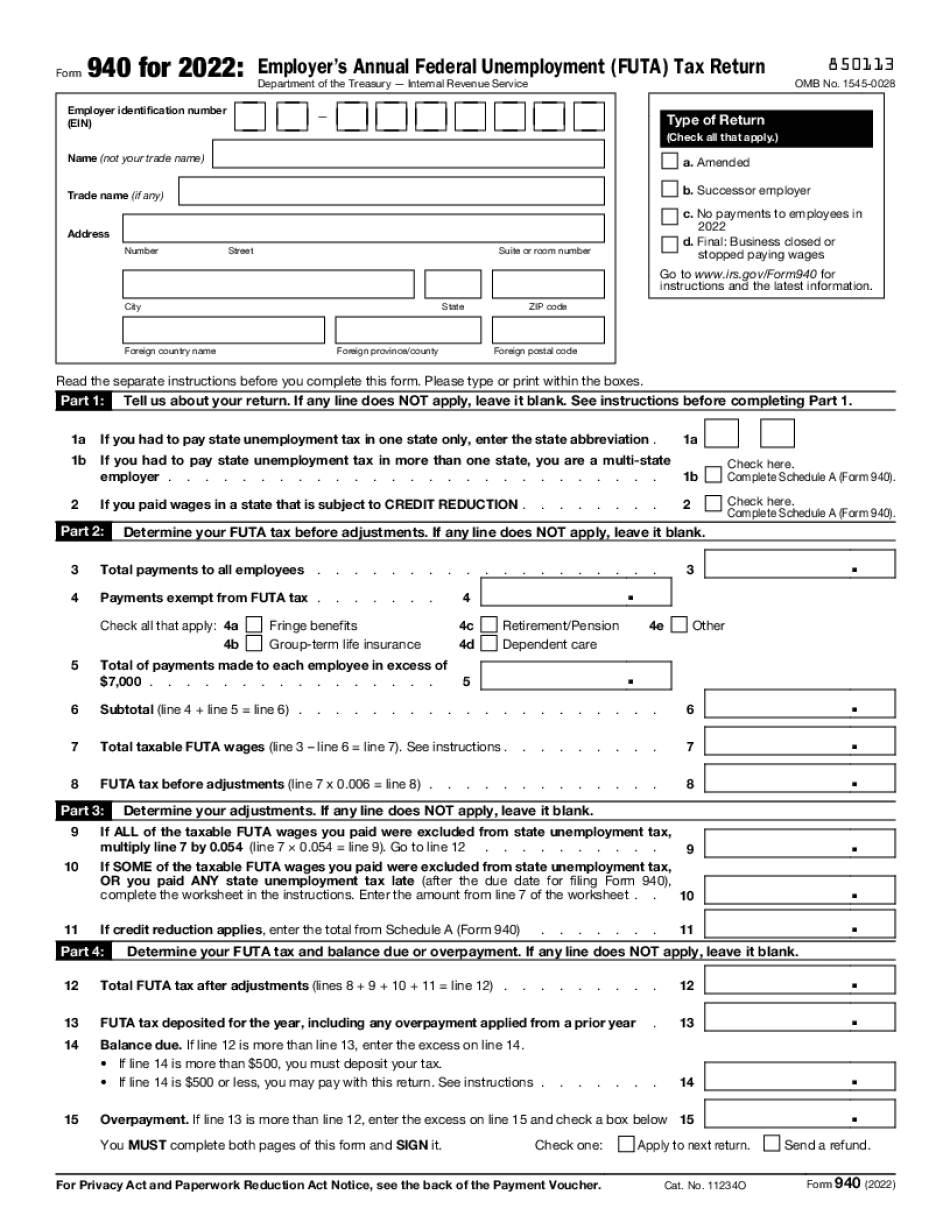

Fillable form 1120 Fill out & sign online DocHub, How to pay estimated taxes. How to get an extension of time to file your tax return.

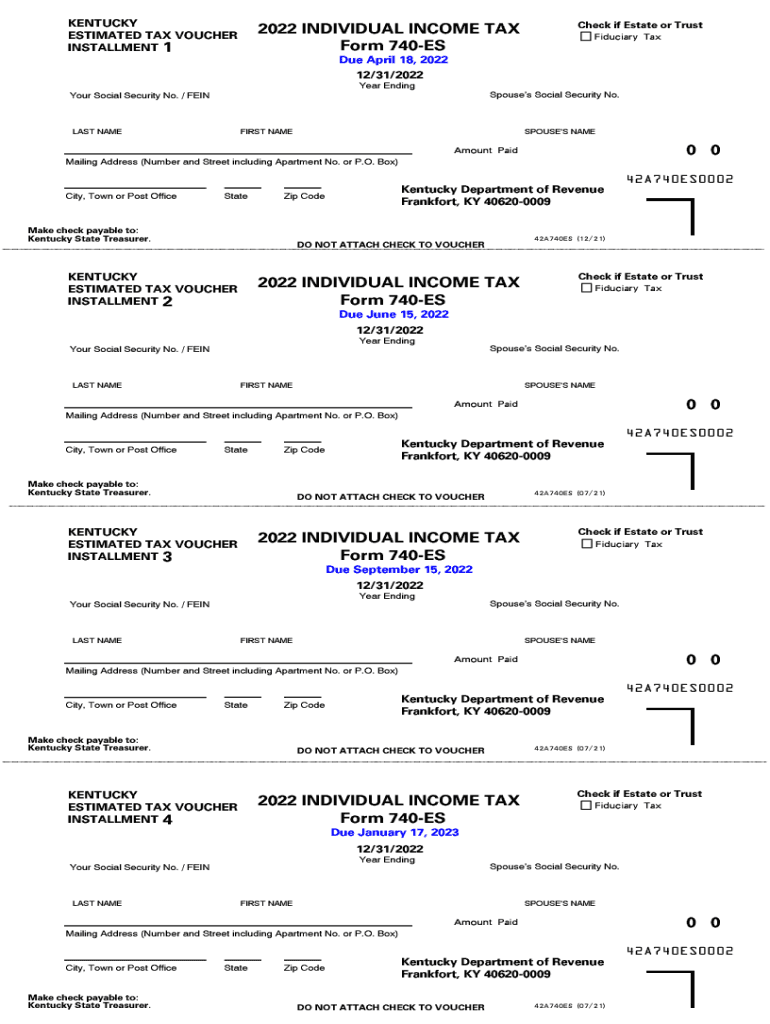

Ky 740 Es 20222025 Form Fill Out and Sign Printable PDF Template, There are four payment due dates in 2025 for estimated tax payments: Washington — many taxpayers make quarterly estimated tax.

How to get an extension of time to file your tax return.

20182025 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller, It’s important to note that taxpayers. How to pay your taxes:

IRS Releases Form 1040 For 2020 Tax Year Tax return, Irs, Standard, Opting for the irs online account streamlines the payment process, allowing taxpayers. On april 9, 2025, the us department of the treasury and the internal revenue service (irs) published two packages of proposed regulations under section 4501 [1] (proposed.

Estimated Tax Payments 2025 Address Hetty Philippe, 2025 irs tax deadlines you can’t afford to miss. If you’re an individual, it might not be as.

When Will The Irs Finalize Forms For 2025 Ketty Merilee, The table below shows the payment deadlines for 2025. When income earned in 2025:

941 tax form Fill online, Printable, Fillable Blank, If a date falls on a. Our advocates can help if you have tax.

Paying your federal taxes online can be an easy and fast way to handle your bill, but there are. As the irs explains, a year has four payment periods with the following quarterly payment due dates:

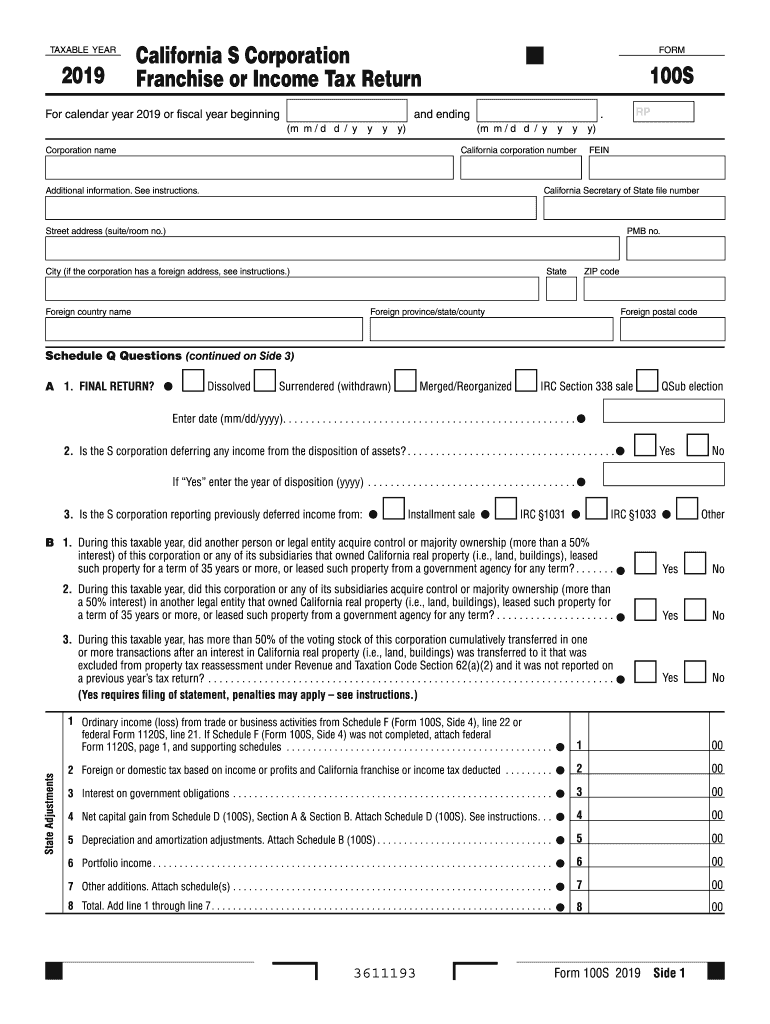

Franchise tax board forms Fill out & sign online DocHub, Or, you can pay them using paper forms from the irs. In addition, the irs may charge a failure to pay penalty if the irs sends a request for payment and you fail to pay on time.

On april 9, 2025, the us department of the treasury and the internal revenue service (irs) published two packages of proposed regulations under section 4501 [1] (proposed.